-

U.S. Office Address: 2319 S.W. 29 Ave., Miami, Fl. 33145

U.S.Mailing Address: 2520, Coral Way, Suite 2014, Miami, FL 33145

U.S. Number: 754-368-2330

For non-US individuals who have tax obligations in the United States, obtaining an Individual Taxpayer Identification Number is often the first and most important step. An ITIN allows the IRS to track tax filings for people who are not eligible for a Social Security Number but still need to report US sourced income.

Foreign nationals selling US property, earning rental income, or filing FIRPTA related tax returns cannot move forward without an ITIN. Firpta Tax Returns helps international taxpayers understand the process and complete ITIN Form W-7 correctly to avoid delays and rejections.

An ITIN is a nine digit tax identification number issued by the IRS. It is used strictly for federal tax purposes and does not provide work authorization or immigration status.

You may need an ITIN if you fall under one of the following situations.

Without an ITIN, the IRS cannot process your tax return, refund, or FIRPTA exemption application.

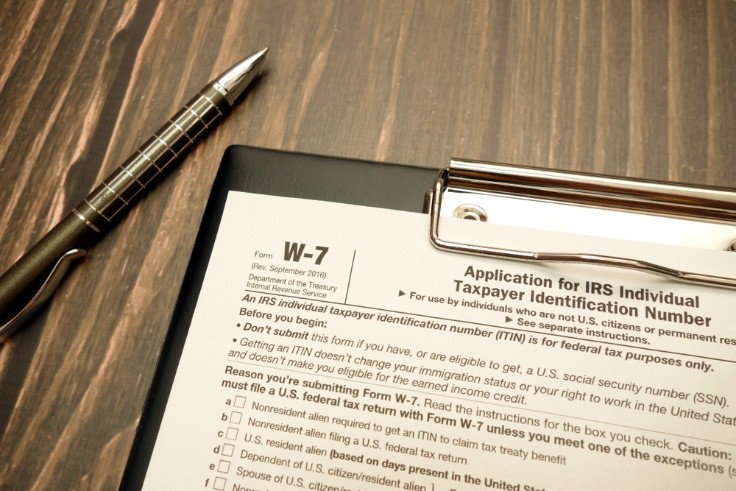

ITIN Form W 7 is the official IRS application used to request a new ITIN or renew an expired one. The form collects personal details such as legal name, country of citizenship, date of birth, and foreign tax identification number when applicable.

A critical part of Form W 7 is selecting the correct reason for applying. This reason must clearly match your tax situation. For foreign property sellers, the most common reason is the requirement to file a US tax return related to FIRPTA withholding.

The form must be submitted along with supporting identification documents and, in most cases, a completed federal tax return.

The IRS requires proof of both identity and foreign status. Submitting incorrect or incomplete documents is one of the most common reasons for ITIN rejection.

Accepted documentation generally includes the following:

Documents must be current and properly certified. Mailing original documents without professional guidance can create unnecessary risk.

FIRPTA requires buyers to withhold a percentage of the sale price when a foreign individual sells US real estate. This withholding is sent directly to the IRS.

To recover excess withholding or apply for a reduced withholding certificate, the seller must file a US tax return. An ITIN is mandatory for this filing.

Without an ITIN, foreign sellers often face these issues:

Firpta Tax Returns ensures that ITIN applications are aligned with FIRPTA deadlines so sellers can access their funds without unnecessary delays.

Many ITIN applications fail due to avoidable mistakes. These errors often result in rejection letters and long processing delays.

The most frequent issues include: Selecting the wrong reason on Form W-7

Professional review significantly improves approval success and shortens processing time.

Firpta Tax Returns specializes in ITIN applications for foreign nationals with US tax obligations. The team understands how ITIN filings connect with FIRPTA returns, exemption affidavits, and withholding refunds.

Clients receive structured guidance on documentation, application accuracy, and submission timing. Each application is reviewed to ensure IRS compliance before filing.

For property sellers, ITIN assistance is often coordinated with FIRPTA Solutions and Services to ensure a smooth transition from sale closing to tax filing and refund recovery.

Timing plays a major role in avoiding tax complications. Applying early allows flexibility and prevents refund delays.

You should consider applying for an ITIN if you plan to:

Early preparation reduces stress and ensures compliance before IRS deadlines.

Understanding ITIN Form W-7 is essential for non US taxpayers navigating US tax requirements. From filing accurate returns to complying with FIRPTA regulations, an ITIN enables proper reporting and access to refunds.

Firpta Tax Returns offers reliable support for ITIN applications, renewals, and FIRPTA related filings. With expert handling, international taxpayers can stay compliant while avoiding costly delays.

So, contact Firpta Tax Returns today. Our team provides end to end support to help you file confidently and recover what you are entitled to.

Any individual required to file a US tax return but not eligible for a Social Security Number must apply for an ITIN.

In most cases, Form W 7 must be submitted with a federal tax return unless an IRS exception applies.

Processing typically takes several weeks, depending on IRS workload and document accuracy.

Yes, an ITIN is required to file the tax return needed to claim FIRPTA withholding refunds.

ITINs may expire if not used for a certain period and may require renewal before filing again.