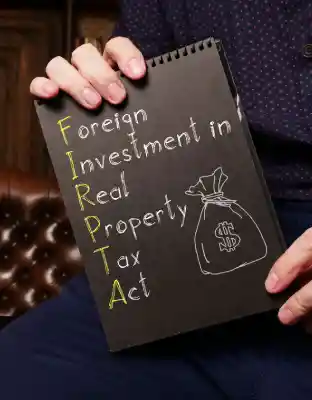

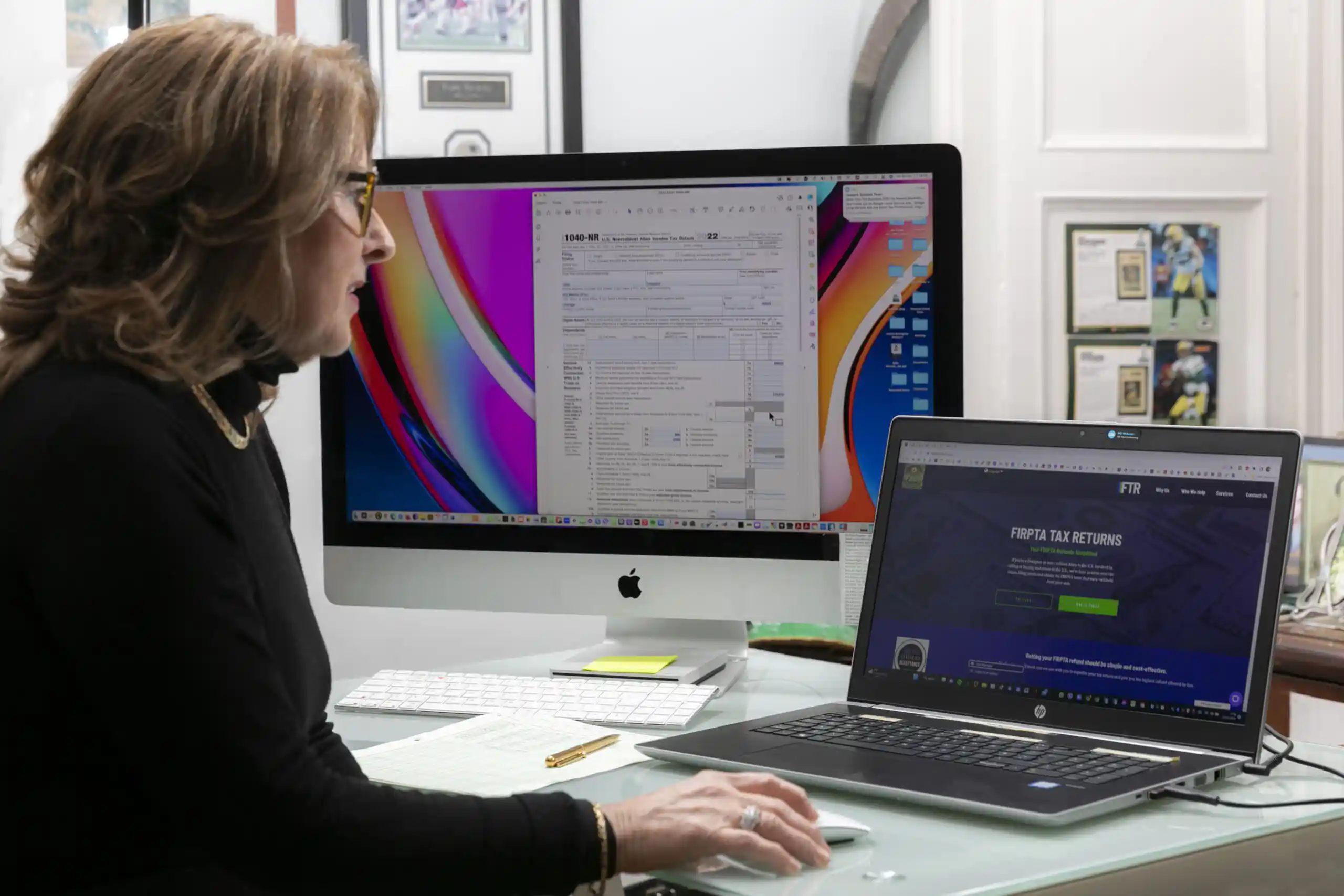

The FIRPTA withholding certificate is used to minimize the amount of the sale price that is withheld. Here is an example of why it is necessary: Michelle is a foreign national who owns a U.S. property that she purchased for $800,000. She uses it as a rental property. Michelle sees the market declining and wants to pull the money out so that she is liquid to make other investments. She enters into a residential purchase agreement to sell the property for $840,000.

The capital gain on this type of sale is probably nil, once the expenses are factored into the sale price.

But, unless Michelle is able to obtain a withholding certificate, the US government will require that 15% of the sale price is withheld, which is $126,000.